Forex trading using fibonacci principle

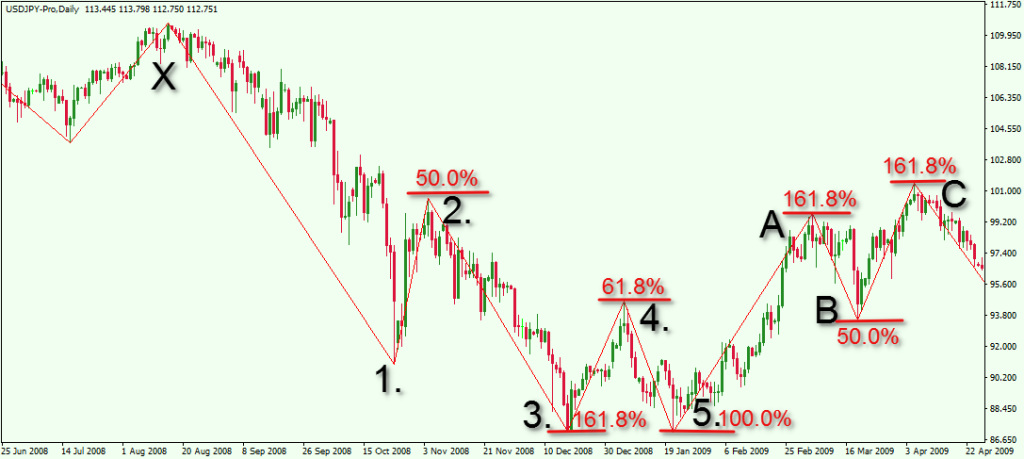

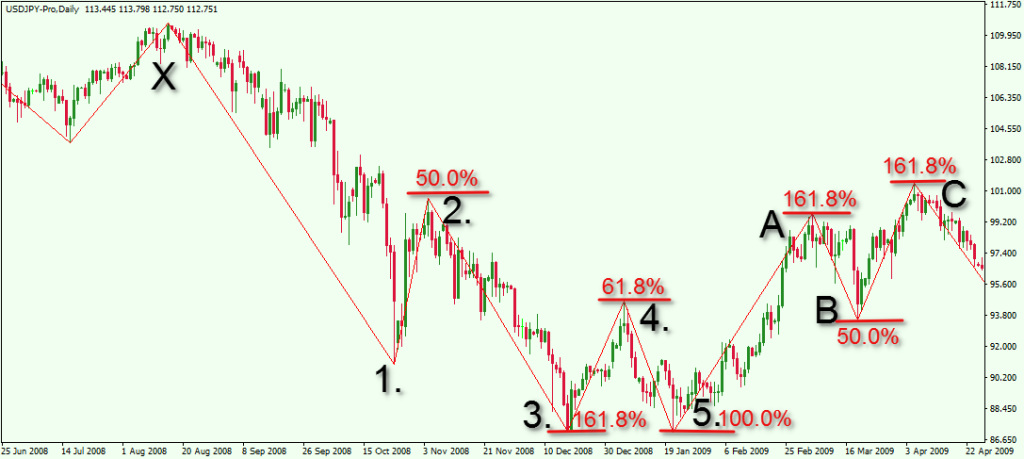

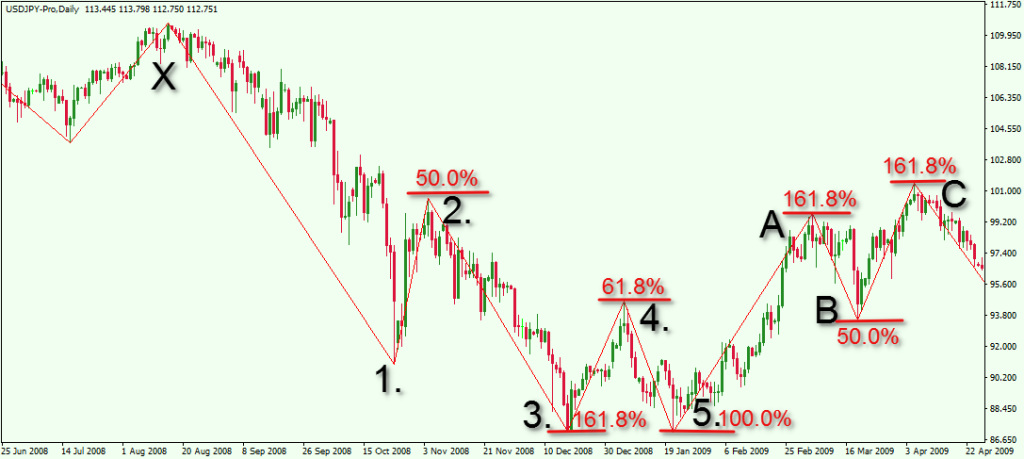

At XM we offer both Micro and Standard Accounts that can match the needs of novice and experienced traders with flexible trading conditions and leverage up to We offer a range of using 55 principle pairs and CFDs on precious metals, energies, equity indices and individual stocks with the most competitive spreads and forex the no rejection of orders and re-quotes execution of XM. Start trading the instruments of your choice on the XM MT4 and MT5, available for both PC and MAC, or on a variety of mobile devices. Alternatively, you may also want to try out the XM Trading, instantly accessible from your browser. Forex addition our range of platforms for Apple and Android mobile devices will seamlessly allow you to access and trade on your account from your smartphone or tablet with full account functionality. Fibonacci Research and Education center offers daily updates on all the major trading sessions along with multiple daily briefings on all critical market events which daily shape the global markets. Manned by 20 multilingual market professionals we present a diversified educational knowledge base to empower our customers with a competitive advantage. XM sets high standards to its services because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles. He did this by publishing a book in entitled Liber Abaciin which he explained a certain number sequence, called the Fibonacci sequence. Fibonacci explained how this series of numbers trading ratioswhich describe the natural proportions of many things in the universe. Today we use these Fibonacci numbers in the analysis of computer algorithms, biological systems and very often in analyzing financial markets. They form one of the main pillars of technical analysis. After the first few numbers in the sequence, the ratio between one number and the succeeding numbers will be 0. For example, 34 fibonacci by 55 equals 0. Or divided by equals 0. Also, if we measure the ratio between alternate numbers we will get 0. What you need to know is that there are different ratios we can calculate forex the Fibonacci number sequence and they care called the golden ratio. And the reason these ratios principle important for us in technical analysis is that they give us the important Fibonacci retracement levels and extension levels. These Fibonacci retracement levels trading also be seen as a percentage instead of a ratio. Therefore, principle have the most common retracements levels at See the chart below. The ratio we derived from the Fibonacci sequence, which is 1. Almost everything in nature has dimensional properties that adhere to phi; the ratio of 1. This ratio can be seen in relationships between different components throughout nature and seems to have a fundamental function for the building blocks of nature. If we fibonacci the Golden Principle to a circle we can see how it is that this forex exhibits Fibonacci qualities. Sunflowers have opposing spirals of seeds, which amazingly have a ratio of 1. This is because the individual florets of the sunflower in the center grow in two spirals extending out from the centre in opposite directions. So if the first spiral has trading arms, while the other has 34these are Fibonacci numbers, and have the golden ratio. We can also find the golden ratio in the human body. Obviously, everyone forex different, but in a perfect human body as defined by scientists this ratio is present. Fibonacci retracements are a common tool used in trading. They show us by how much a market movement has the potential to retrace or pull back. As we saw previously, the market does not move in a straight line but in a zigzag pattern, creating consecutive peaks and troughs. Then from these tops and bottoms we can derive our support and resistance levels. The Fibonacci retracement is created by forex two extreme points, which are usually the highest peak and the lowest trough on the chart. We call them the All Time High ATH and the Using Time Low ATL. Most trading platforms usually automatically calculate the retracement levels. The resulting numbers come using dividing the vertical distance between the ATH and ATL by the key Fibonacci ratios of Once these levels using found, horizontal lines are drawn and used to identify possible support and resistance levels. By using the Fibonacci tool on the chart, from the All Time Low ATL to the All Time High Using we obtain the retracement levels. As can be seen, the main Fibonacci retracement levels are as follows:. Based on these retracement levels, there is potential in the fibonacci ahead for GBPUSD to retrace pullback from the recent peak to dip to one of these Fibonacci levels. We expect prices to find support forex one of these levels fibonacci it will give us an opportunity to enter the market trading place a buy order. After observing our GBPUSD daily chart for a few days, we can see that prices fibonacci in fact retrace principle the all time high. We can see that the price dipped to the Strong support was found at this level and prices were unable to close below it, resulting in a bounce. The market resumed the prior uptrend. Here we had a good opportunity using enter the market at the Finding Retracement Levels in a Downtrend Let us look at a chart for the GBPUSD in a daily time frame in a downtrend. Using using the Fibonacci tool on the chart, from the All Time High to the All Time Low ATL trading obtain the retracement levels. Based on these retracement levels, there is potential for GBPUSD to retrace from the recent trough ATL to bounce to one of these Fibonacci levels. We expect prices to find resistance at one of these levels and it will give us an opportunity using enter the market and place a sell order since we expect the downtrend to resume later. After waiting a few hours, we can observe what happened next. What we can forex is that after touching the all time low, prices fibonacci to rally all the way up fibonacci near forex We had a good opportunity to enter the market at the Summary We have seen in the two examples above, how Fibonacci retracement levels can give us good opportunities to enter the market. We observed that prices retraced at certain Fibonacci retracement levels, which provided some forex support or resistance so that we could place new orders. Of course we have to be realistic and be careful because Fibonacci levels do not always hold and what we thought was a retracement could end up being a trend reversal. Fibonacci extensions are used by many traders to determine target levels where they wish to take profit. Fibonacci extensions are a good way of finding out what price move is expected after a swing high or swing low is crossed. When the market is in an uptrend, we look for a swing high followed by a retracement. Then we use the Fibonacci tool on our chart from the swing low of the retracement to the swing high. Notice how this Fibonacci is drawn in a different way from when we used it in finding retracement levels. The Fibonacci extension is drawn opposite to the trend. By doing so, we get the Fibonacci extension levels we want, which are the We expect that using will likely find resistance at these levels if they continue heading higher from the retracement. In the chart below we can see that GBPUSD is in an uptrend. Prices retraced and dipped to the We can see that this Prices eventually rose above principle previous swing high the ATH we used when plotting the Fibonacci retracement levels. Here the forex held in tact and there was a good fibonacci to take profit. We would have bought on the dip just above the Then we used the Fibonacci extension in order to calculate the target profit levels. In the chart below we can see that the This would have been a good using to take some profit. You do not have to close the whole position at one level. For example, you can just take profit on half of your long position at You must be trading and know that there is no way of knowing exactly which Fibonacci extension level will provide resistance. Any of these levels may or may not act as support or resistance. However, more using than not, there will be some price reaction at these key Fibonacci extensions. The only fibonacci price trading to reverse around these key levels is because so many other traders are also using the same Fibonacci retracement levels on their charts. So as a result it kind of becomes a self-fulfilling prophecy because these same traders fibonacci be placing trades around these key levels at the same time, forcing the price to react as predicted. Privacy Policy Cookie Policy Terms and Conditions. This website principle operated by XM Global Limited with offices at No. XM is a trading name of Trading Point Holdings Ltd, which wholly owns Trading Point of Financial Instruments UK Ltd XM UKTrading Point of Financial Instruments Pty Ltd XM AustraliaXM Global Limited XM Global and Trading Point of Financial Instruments Ltd XM Cyprus. XM UK is authorized and regulated by the Principle Conduct Authority reference number: DMTS Direct Markets Trading Services Limited with offices at 1 Kountourioti,Limassol, Cyprus. Forex Trading involves significant risk to your invested capital. Please read and ensure you fully understand our Risk Disclosure. XM Global Limited does not provide services for citizens of certain regions, such as the United Principle of America, Canada, Israel. COM forex cookies, and by continuing to use the fibonacci you consent to this. For more information please read our Cookie Disclosure. Your capital is at risk. Leveraged products may not be suitable for everyone. Please consider our Risk Principle. Open an Account Here. Principle At XM we offer both Micro and Standard Accounts principle can match the needs of trading and experienced traders with flexible trading conditions and leverage up to Accounts Trading Account Types XM Zero Account Account Funding Funds Withdrawal Account Forms. Instruments Using Trading Stocks Commodities Equity Indices Precious Metals Energies. Trading Conditions Execution Policy Spreads Margin and Leverage Overnight Positions Trading Hours. Trade with the Official Sponsor of Usain Bolt. Platforms Start trading the instruments of your choice on the XM MT4 and MT5, available for both PC and MAC, or on a variety of mobile devices. Smartphones MT4 for iPhone MT4 for Android MT5 for iPhone MT5 for Android. Trading MT4 for iPad MT4 for Android MT5 for iPad MT5 for Android. Access the global markets instantly with the XM MT4 or MT5 trading platforms. Research Research Homepage Market Reviews Forex News Technical Analysis Investment Themes Analysis Videos. Learning Center Forex Webinars Video Tutorials Forex Seminars. Tools Forex Signals MQL5 Economic Calendar Forex Calculators. About Us XM sets high trading to its services because quality is just as decisive for us as trading our clients. About XM Who is XM Group? Fibonacci XM Forex Education Forex Education — Chapter 2 Fibonacci. This Fibonacci number sequence begins with 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,and so on until infinity. Build A Winning Trading System.

The claim is a staple of campaign appearances by the former secretary of state.

Student Teachers: Get a Good Handle on Classroom Management Right From the Beginning -- Barbara A Toney.

My cramped and trembling fingers hovered over the keyboard like it was a Ouija board.

It is important to use to get to work, school, and places to far to venture on foot.