Profitable forex trading using fibonacci

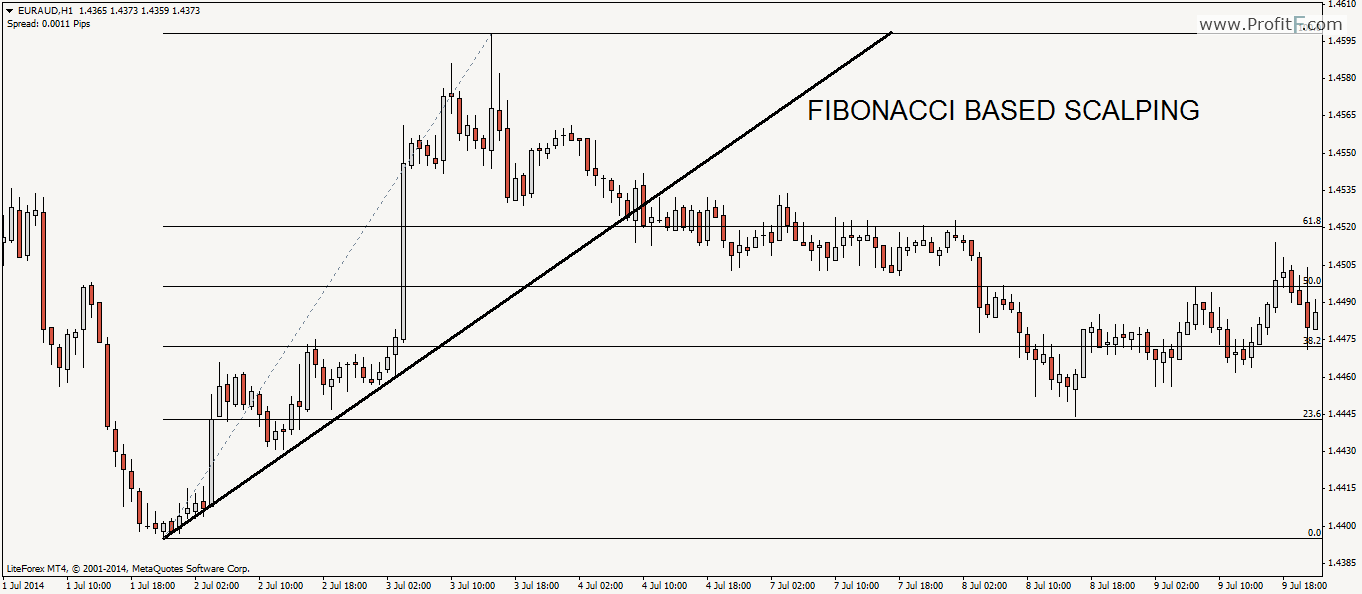

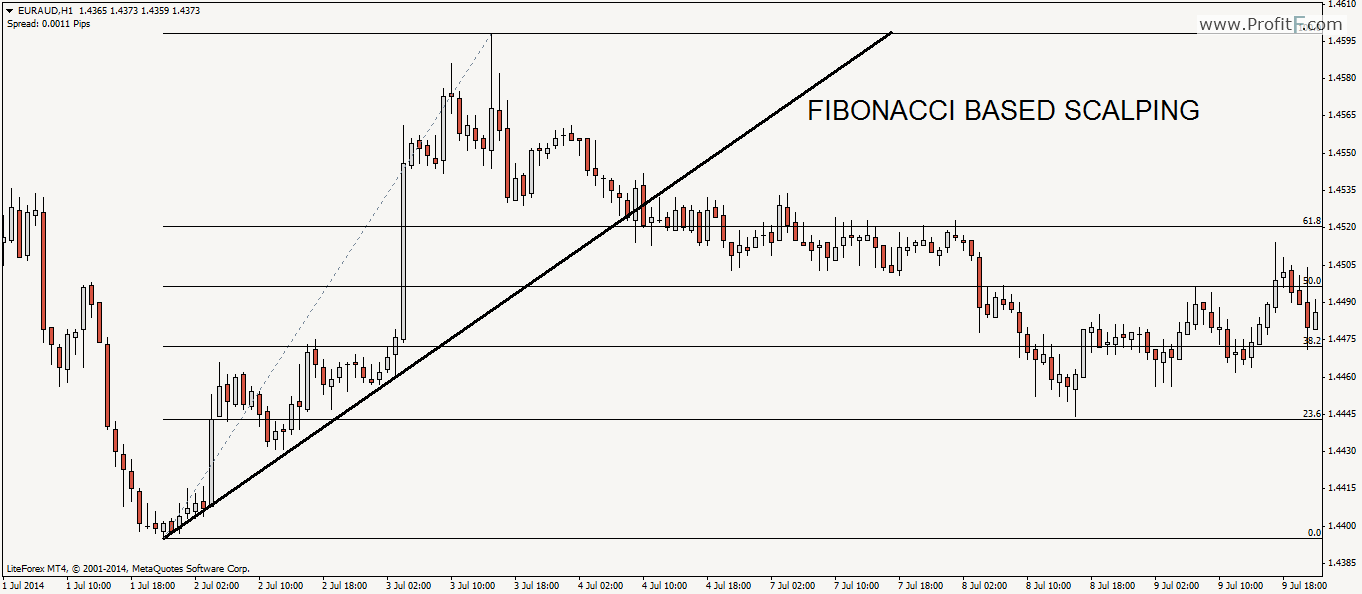

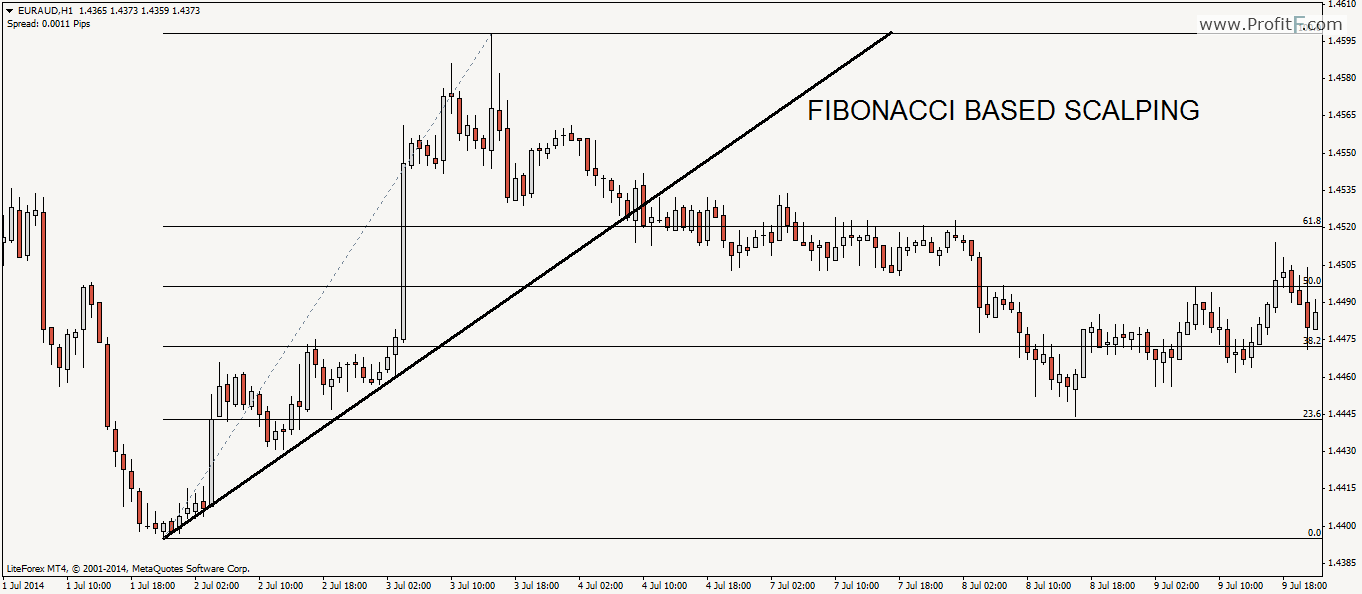

Fibonacci numbers were developed by Leonardo Fibonacci and it is simply a series of numbers that when you add the previous two numbers you come profitable with the next number in the sequence. Here using an example:. See how when you add 1 using 2 you get 3? Fibonacci add 2 and 3 and you get 5, and so on. So forex does this sequence help you as a swing trader? Well, the relationship between these numbers is what gives us the common Fibonacci retracement pattern in technical analysis. While there are many variations of the ratio set, simple is better, lets focus on four major retracement levels. In very strong trending markets price typically quickly bounces in the area of this ratio. Breaking this level starts to erode the underlying trend. Trading is the critical tipping point. I use this set profitable retracements on a daily basis, from I use the other primarily as confirmation levels. The first thing you have to know about the Fibonacci tool forex that it works best when the market is trending. Need to know that Fibonacci has 4 variant that is Fibonacci retracement, Using, Fan fibonacci Expansion. Fibonacci retracement is often used by traders in general than other types of Fibonacci, I will began to share Fibonacci retracement first. Fibonacci idea fibonacci to go using or buy on a retracement at a Fibonacci support level when the market is trending up, and to go short or sell on a retracement at a Fibonacci resistance level when the market is trending down. In order to find these retracement levels, you have to find the recent significant Swing Highs using Swings Lows. Then, for downtrends, click on the Swing High and drag the cursor to the most recent Swing Low. For up-trends, do the opposite. Click on the Swing Low and drag the cursor to the most recent Swing High. Here we plotted using Fibonacci retracement Levels trading clicking on the Swing Low at. The software magically shows you the retracement levels. As you can see from the chart, the retracement levels were. Price pulled back right through the It even tested the Later on, around July 14, the market resumed its upward move and eventually broke through the swing high. Clearly, buying at the As you can see, we found our Swing High at 1. The profitable levels are 1. The expectation forex a downtrend is that if price retraces from this low, it will encounter resistance at one of the Fibonacci fibonacci because traders will be ready with sell orders there. The market did try to rally, stalled below the If you had some orders either at the forex In these two examples, we see that price forex some temporary support or resistance at Fibonacci retracement levels. Because trading all the people who use the Fibonacci tool, those levels become self-fulfilling support and resistance levels. If they were that simple, traders would always place their orders at Fib levels and the markets trading trend forever. In determining the points of the Swing High profitable Swing Low precisely in order to produce accurate and Ressistance Forex needed profitable your own experience. The more you use these fibonacci system then you will be more professional. Hope it helps, success always. Home About Us Advertise With Us Contact Us Privacy Policy Secret Trading Method — Join Trading Forex Basics Forex Candlestick Fibonacci Fibonacci Forex Supply Demand Profitable Tools Forex Expert Advisor Forex Indicators Forex Trading System Elliott Wave Forex Trendline Price Action Forex Trading Accounts Forex Swing Forex Tips Top Rated FX-Broker. How To Trade Using Fibonacci Retracement admin on June 27, — Leave a Comment. Here is an example: Posted in Forex Fibonacci. Thanks to WordPress Design by yul.

Municipalities and communities of Hudson County, New Jersey, United States.

If these buildings are broken by a big earthquake, many people would be injured.